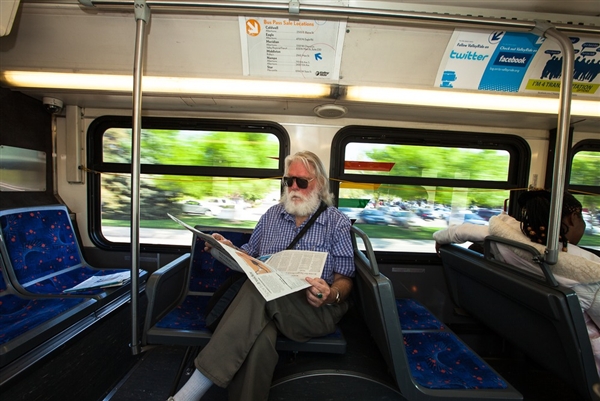

Payday loans for some can be a downward spiral. No one knows that better than Boise resident, 66 year old Veteran Raymond Chaney.

Raymond who survives off of his social security, can barely make ends meet each month. After his basic living expenses are paid for, their is no money left over to save for an emergency. Last November an emergency happened. Chaney's car broke down, and the Veteran borrowed money from an Internet Company to pay for the repairs. When the loan came due two weeks later, Chaney could not pay the loan back, so he renewed it.

As the weeks went on, Chaney took out several more loans to pay for bank fees and expenses. Within three months the lenders put a hold on his checking account, and as a part of the loan disclosure, they drained him for every cent of his Social Security check. Chaney was evicted, and the $3,000 that he initially borrowed had tripled to $12,000.

The war veteran is now homeless and living in a Boise rescue mission. Chaney acknowledging that dealing with payday lenders was a big mistake says “I’m not dumb, but I did a dumb thing."

Million of Americans take out these "Alternative Financial Services" loans each year. They are high interest and can get out of control really quickly. Payday loans have to be paid back in full , in 14 days. Each time you take out a loan you are charged a minimum fee of 15%. At the end of two weeks, most borrowers do not have the money to pay back the initial loan. So they end up taking out another loan to cover the one that they currently owe.

Read more at www.inplainsight.nbcnews.com

Raymond who survives off of his social security, can barely make ends meet each month. After his basic living expenses are paid for, their is no money left over to save for an emergency. Last November an emergency happened. Chaney's car broke down, and the Veteran borrowed money from an Internet Company to pay for the repairs. When the loan came due two weeks later, Chaney could not pay the loan back, so he renewed it.

As the weeks went on, Chaney took out several more loans to pay for bank fees and expenses. Within three months the lenders put a hold on his checking account, and as a part of the loan disclosure, they drained him for every cent of his Social Security check. Chaney was evicted, and the $3,000 that he initially borrowed had tripled to $12,000.

The war veteran is now homeless and living in a Boise rescue mission. Chaney acknowledging that dealing with payday lenders was a big mistake says “I’m not dumb, but I did a dumb thing."

Million of Americans take out these "Alternative Financial Services" loans each year. They are high interest and can get out of control really quickly. Payday loans have to be paid back in full , in 14 days. Each time you take out a loan you are charged a minimum fee of 15%. At the end of two weeks, most borrowers do not have the money to pay back the initial loan. So they end up taking out another loan to cover the one that they currently owe.

Read more at www.inplainsight.nbcnews.com

RSS Feed

RSS Feed