The President’s Fiscal Year 2014 Budget demonstrates that we can make critical investments to strengthen the middle class, create jobs, and grow the economy while continuing to cut the deficit in a balanced way.

The President believes we must invest in the true engine of America’s economic growth – a rising and thriving middle class. He is focused on addressing three fundamental questions: How do we attract more jobs to our shores? How do we equip our people with the skills needed to do the jobs of the 21st Century? How do we make sure hard work leads to a decent living? The Budget presents the President’s plan to address each of these questions.

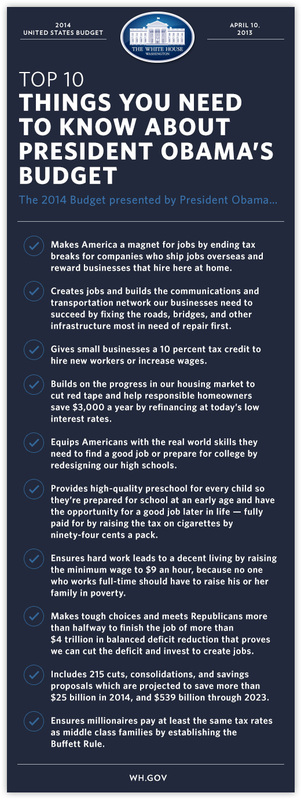

To make America once again a magnet for jobs, the Budget invests in high-tech manufacturing and innovation, clean energy, and infrastructure, while cutting red tape to help businesses grow. To give workers the skills they need to compete in the global economy, it invests in education from pre-school to job training. To ensure hard work is rewarded, it raises the minimum wage to $9 an hour so a hard day’s work pays more.

The Budget does all of these things as part of a comprehensive plan that reduces the deficit and puts the Nation on a sound fiscal course. Every new initiative in the plan is fully paid for, so they do not add a single dime to the deficit. The Budget also incorporates the President’s compromise offer to House Speaker Boehner to achieve another $1.8 trillion in deficit reduction in a balanced way. When combined with the deficit reduction already achieved, this will allow us to exceed the goal of $4 trillion in deficit reduction, while growing the economy and strengthening the middle class. By including this compromise proposal in the Budget, the President is demonstrating his willingness to make tough choices and his seriousness about finding common ground to further reduce the deficit.

KEY BUDGET FACTS

To compete in the 21st Century economy and make America a magnet for jobs, the Budget invests in American innovation, reviving our manufacturing base and keeping our Nation at the forefront of technological advancement. And to ensure our energy security and combat climate change, it continues to focus on energy production, the development of clean energy alternatives, and the promotion of energy efficiency efforts in both the public and private sectors.

The Budget invests in repairing our existing infrastructure and building the infrastructure of tomorrow, including high-speed rail, high-tech schools, and power grids that are resilient to future extreme conditions. These investments will both lay the foundation for long-term economic growth and put workers back on the job now.

To equip our workers with the skills they need to fill the jobs of the 21st Century economy, the Budget includes investments and reforms in education and training. It makes a major new commitment to early childhood education; sustains investments in K-12 schools, while ramping up innovation; redoubles our focus on science, technology, engineering, and mathematics (STEM) education to prepare our students for the jobs of tomorrow; and includes new initiatives to make college more affordable.

The President believes that today’s tax code has become overly complex and inequitable and that we should immediately begin the process of reforming the individual and business tax systems. As a down payment on comprehensive tax reform, the Budget offers detailed proposals to broaden the tax base, close tax loopholes, and establish a Buffett Rule that will prevent millionaires from taking advantage of special provisions to pay taxes at lower rates than many middle-class families do.

The Budget builds on the progress made over the last four years to expand opportunity for every American and every community willing to do the work to lift themselves up. It creates new ladders of opportunity to ensure that hard work leads to a decent living. It expands early childhood education to give children a foundation for lifelong learning. It supports a partnership with communities to help them thrive and rebuild from the Great Recession. It creates pathways to jobs for the long-term unemployed and youth who have been hard hit. It rewards hard work by increasing the minimum wage so a hard day’s work pays more. And it strengthens families by removing financial deterrents to marriage and supporting the role of fathers.

The President is committed to continuing to reduce the deficit in a balanced way. He is determined to do this in a way that replaces the economically damaging across-the-board cuts of sequestration with smart, targeted efforts to cut wasteful spending, strengthen entitlements, and eliminate loopholes for the wealthiest through tax reform.

The President stands by the compromise offer he made to Speaker Boehner during “fiscal cliff” negotiations in December 2012. The Budget includes all of the proposals in that offer, which would achieve $1.8 trillion in additional deficit reduction over the next 10 years, bringing total deficit reduction to $4.3 trillion. This represents more than enough deficit reduction to replace the cuts required by the Joint Committee sequestration. By including this compromise proposal in the Budget, the President is demonstrating his willingness to make tough choices to find common ground to further reduce the deficit. This offer includes some difficult cuts that the President would not propose on their own, such as an adjustment to inflation indexing requested by Republicans. But there can be no sacred cows for either party. The key elements of the offer include:

In addition, the Budget includes a series of new proposals to root out waste and reform and streamline government for the 21st Century. In total, it includes 215 cuts, consolidations, and savings proposals, which are projected to save more than $25 billion in 2014.

(Whitehouse.gov)

The President believes we must invest in the true engine of America’s economic growth – a rising and thriving middle class. He is focused on addressing three fundamental questions: How do we attract more jobs to our shores? How do we equip our people with the skills needed to do the jobs of the 21st Century? How do we make sure hard work leads to a decent living? The Budget presents the President’s plan to address each of these questions.

To make America once again a magnet for jobs, the Budget invests in high-tech manufacturing and innovation, clean energy, and infrastructure, while cutting red tape to help businesses grow. To give workers the skills they need to compete in the global economy, it invests in education from pre-school to job training. To ensure hard work is rewarded, it raises the minimum wage to $9 an hour so a hard day’s work pays more.

The Budget does all of these things as part of a comprehensive plan that reduces the deficit and puts the Nation on a sound fiscal course. Every new initiative in the plan is fully paid for, so they do not add a single dime to the deficit. The Budget also incorporates the President’s compromise offer to House Speaker Boehner to achieve another $1.8 trillion in deficit reduction in a balanced way. When combined with the deficit reduction already achieved, this will allow us to exceed the goal of $4 trillion in deficit reduction, while growing the economy and strengthening the middle class. By including this compromise proposal in the Budget, the President is demonstrating his willingness to make tough choices and his seriousness about finding common ground to further reduce the deficit.

KEY BUDGET FACTS

- Creates jobs by responsibly paying for investments in education, manufacturing, clean energy, infrastructure, and small business.

- Includes $1.8 trillion of additional deficit reduction over 10 years, bringing total deficit reduction achieved to $4.3 trillion.

- Represents more than $2 in spending cuts for every $1 of new revenue from closing tax loopholes and reducing tax benefits for the wealthiest.

- Deficit is reduced to 2.8% of GDP by 2016 and 1.7% by 2023 with debt declining as a share of the economy, while protecting the investments we need to create jobs and strengthen the middle class.

- Includes $400 billion in health savings that crack down on waste and fraud to strengthen Medicare for years to come.

To compete in the 21st Century economy and make America a magnet for jobs, the Budget invests in American innovation, reviving our manufacturing base and keeping our Nation at the forefront of technological advancement. And to ensure our energy security and combat climate change, it continues to focus on energy production, the development of clean energy alternatives, and the promotion of energy efficiency efforts in both the public and private sectors.

- Transforms regions across the country into global epicenters of advanced manufacturing with a one-time, $1 billion investment to launch a network of up to 15 manufacturing innovation institutes.

- Maintains our world-leading commitment to science and research by increasing nondefense research and development (R&D) investment by 9% above the 2012 levels.

- Continues President’s “all-of-the-above” strategy on energy – investing in clean energy R&D, promoting the safe production of natural gas, encouraging States to cut energy waste with a Race-to-the-Top challenge to cut energy waste and modernize the grid, creating an Energy Security Trust to fund research efforts that would help shift cars and trucks off oil, and making permanent the tax credit for renewable energy production.

- Enhances preparedness and resilience to climate change, safeguarding communities and Federal investments, while strengthening efforts to reduce carbon pollution domestically and internationally.

The Budget invests in repairing our existing infrastructure and building the infrastructure of tomorrow, including high-speed rail, high-tech schools, and power grids that are resilient to future extreme conditions. These investments will both lay the foundation for long-term economic growth and put workers back on the job now.

- Provides $50 billion for upfront infrastructure investments, including $40 billion for “Fix it First” projects, to invest immediately in repairing highways, bridges, transit systems, and airports nationwide; and $10 billion for competitive programs to encourage innovation in completing high-value infrastructure projects.

- Boosts private investment in infrastructure by creating a Rebuild America Partnership.

- Establishes an independent National Infrastructure Bank to leverage private and public capital to support infrastructure projects of national and regional significance.

- Creates America Fast Forward (AFF) Bonds, building on the successful Build America Bonds program to attract new sources of capital for infrastructure investment.

- Dedicates funding for the development of high-speed rail to link communities across the country, the Next Generation Air Transportation System (NexGen) to improve air travel and safety, and a robust long term increase in levels for core highways, transit, and highway safety programs.

- Expedites infrastructure projects by modernizing the Federal permitting process to cut through red tape while creating incentives and better outcomes for communities and the environment. Establishes a new goal of cutting timelines in half for major infrastructure projects in areas such as highways, bridges, railways, ports, waterways, pipelines, and renewable energy.

To equip our workers with the skills they need to fill the jobs of the 21st Century economy, the Budget includes investments and reforms in education and training. It makes a major new commitment to early childhood education; sustains investments in K-12 schools, while ramping up innovation; redoubles our focus on science, technology, engineering, and mathematics (STEM) education to prepare our students for the jobs of tomorrow; and includes new initiatives to make college more affordable.

- To build a foundation for success in the formative early years of life, increases access to high-quality early childhood education with a Preschool for All initiative.

- In partnership with the States, provides all low- and moderate-income four-year-olds with high-quality preschool, while encouraging States to serve additional four-year-olds from middle class families. The initiative also promotes access to full-day kindergarten and high-quality early education programs for children under age four.

- The Preschool for All initiative is financed by raising the Federal tax on cigarettes and other tobacco products, which would also have substantial public health impacts, particularly by reducing youth smoking.

- The Budget makes companion investments in voluntary home visiting programs, preserving child care access, and expanding high-quality care for infants and toddlers through new Early Head Start-Child Care Partnerships.

- Creates a new, competitive fund for redesigning high schools to focus on providing challenging and relevant experiences, while promoting and developing partnerships with colleges and employers that improve instruction and prepare students to continue education or transition into skilled jobs.

- Strengthens and reforms career and technical education to better align programs with the needs of employers and higher education to ensure that graduates are poised to succeed.

- Prepares students for careers in STEM-related fields by reorganizing and restructuring Federal STEM education programs to make better use of resources and improve outcomes; and invests in recruiting and preparing 100,000 STEM teachers and creating a new STEM Master Teachers Corps to improve STEM instruction.

- Improves college affordability and value with a continued commitment to Pell Grants; budget-neutral student loan reforms that will make interest rates more market-based; a $1 billion Race-to-the-Top fund to support competitive grants to States that drive higher education reform, while doing more to contain tuition; a $260 million First in the World fund to spur cutting-edge innovations that decrease college costs and boost graduation rates; and reforms to Federal campus-based aid to reward colleges that set responsible tuition policy, provide a high-quality education and better serve students with financial need.

- Improves services for workers and job seekers by revisiting the structure of the Federal job training system, including through the creation of a Universal Displaced Worker program; drives innovation through the Workforce Innovation Fund by testing new State and regional ideas to better deliver training and employment services; and provides $8 billion for a Community College to Career Fund to support State and community college partnerships with businesses and other stakeholders.

The President believes that today’s tax code has become overly complex and inequitable and that we should immediately begin the process of reforming the individual and business tax systems. As a down payment on comprehensive tax reform, the Budget offers detailed proposals to broaden the tax base, close tax loopholes, and establish a Buffett Rule that will prevent millionaires from taking advantage of special provisions to pay taxes at lower rates than many middle-class families do.

- Raises $580 billion for deficit reduction by limiting high-income tax benefits, without raising tax rates.

- Implements the Buffett Rule, requiring that households with incomes over $1 million pay at least 30% of their income (after charitable giving) in taxes.

- Limits the value of tax deductions and other tax benefits for the top 2% of families to 28%, reducing these tax benefits to levels closer to what middle-class families get.

- Provides new tax cuts to encourage hiring and wage increases and to support middle-class families.

- Provides a 10% tax credit for small businesses that hire new employees or increase wages.

- Provides a new tax credit to encourage employers to offer retirement savings plans and expands a tax credit that helps middle-class families afford child care.

- Makes permanent the American Opportunity Tax Credit, which currently helps about 11 million students and families afford college, as well as improvements to the Earned Income Tax Credit and Child Tax Credit that help millions of working families with children make ends meet.

- Pays for middle-class tax relief by eliminating tax loopholes that benefit the wealthy and special interests.

- Ends a loophole that lets wealthy individuals circumvent contribution limits and accumulate millions in tax-preferred retirement accounts.

- Ends a loophole that lets financial managers pay tax on their carried interest income at the lower capital gains rate.

- Eliminates business tax loopholes while providing incentives for research, manufacturing, and clean energy and cutting taxes for small businesses.

- Reforms and makes permanent important tax incentives for research and development, renewable energy, and energy efficiency.

- Cuts taxes for small businesses by letting them claim tax write-offs for up to $500,000 of new investment.

- Eliminates loopholes such as oil and gas tax breaks and special tax rules for corporate jets.

- Proposes reforms to prevent companies from shifting profits overseas to avoid U.S. taxes and to encourage “insourcing” and job creation here in the United States.

The Budget builds on the progress made over the last four years to expand opportunity for every American and every community willing to do the work to lift themselves up. It creates new ladders of opportunity to ensure that hard work leads to a decent living. It expands early childhood education to give children a foundation for lifelong learning. It supports a partnership with communities to help them thrive and rebuild from the Great Recession. It creates pathways to jobs for the long-term unemployed and youth who have been hard hit. It rewards hard work by increasing the minimum wage so a hard day’s work pays more. And it strengthens families by removing financial deterrents to marriage and supporting the role of fathers.

- Creates Promise Zones to rebuild high-poverty communities across the country by attracting private investment to build new housing, improving educational opportunities, providing tax incentives for hiring workers and investing within the Zones, reducing violence and assisting local leaders in navigating Federal programs and cutting through red tape.

- Creates a Pathways Back to Work fund to support summer and year round jobs for low-income youth, subsidized employment opportunities for unemployed and low-income adults, and other promising strategies designed to lead to employment.

- Supports the President’s call to reward hard work by raising the minimum wage to $9.00 an hour.

- Strengthens families by allowing Federal programs like the child support program to implement models that get more men working and engaging with their children, and by addressing financial deterrents to marriage.

The President is committed to continuing to reduce the deficit in a balanced way. He is determined to do this in a way that replaces the economically damaging across-the-board cuts of sequestration with smart, targeted efforts to cut wasteful spending, strengthen entitlements, and eliminate loopholes for the wealthiest through tax reform.

The President stands by the compromise offer he made to Speaker Boehner during “fiscal cliff” negotiations in December 2012. The Budget includes all of the proposals in that offer, which would achieve $1.8 trillion in additional deficit reduction over the next 10 years, bringing total deficit reduction to $4.3 trillion. This represents more than enough deficit reduction to replace the cuts required by the Joint Committee sequestration. By including this compromise proposal in the Budget, the President is demonstrating his willingness to make tough choices to find common ground to further reduce the deficit. This offer includes some difficult cuts that the President would not propose on their own, such as an adjustment to inflation indexing requested by Republicans. But there can be no sacred cows for either party. The key elements of the offer include:

- $580 billion in additional revenue relative to the end-of-year tax deal, from tax reform that closes tax loopholes and reduces tax benefits for those who need them least;

- $400 billion in health savings that build on the health reform law and strengthen Medicare;

- $200 billion in savings from other mandatory programs, such as reductions to farm subsidies and reforms to federal retirement benefits;

- $200 billion in additional discretionary savings, with equal amounts from defense and nondefense programs;

- $230 billion in savings from using a chained measure of inflation for cost-of-living adjustments throughout the Budget, with protections for the most vulnerable;

- $210 billion in savings from reduced interest payments on the debt; and

- $50 billion for immediate infrastructure investments, as noted earlier, to repair our roads and transit systems, create jobs, and build a foundation for economic growth.

In addition, the Budget includes a series of new proposals to root out waste and reform and streamline government for the 21st Century. In total, it includes 215 cuts, consolidations, and savings proposals, which are projected to save more than $25 billion in 2014.

(Whitehouse.gov)

RSS Feed

RSS Feed